How Proximity to Infrastructure Impacts Property Prices and Absorption Rates: A Case Study Analysis

Understanding the role of infrastructure in real estate value is critical for developers, investors, and homebuyers alike. Infrastructure projects such as highways, transit systems, and water lines often result in increased interest and property value in nearby areas. But just how significant is this impact? In this article, we dive into two comparative case mini-studies. The goal: to examine how properties located near newly developed infrastructure perform against those situated farther away.

We’ll analyze changes in pricing and absorption rates (the pace at which homes sell in a given market) for both scenarios. Readers will gain insights into how infrastructure proximity can affect real estate investment decisions with real-world examples, data-driven observations, and takeaway strategies.

Infrastructure and Real Estate: Understanding the Relationship

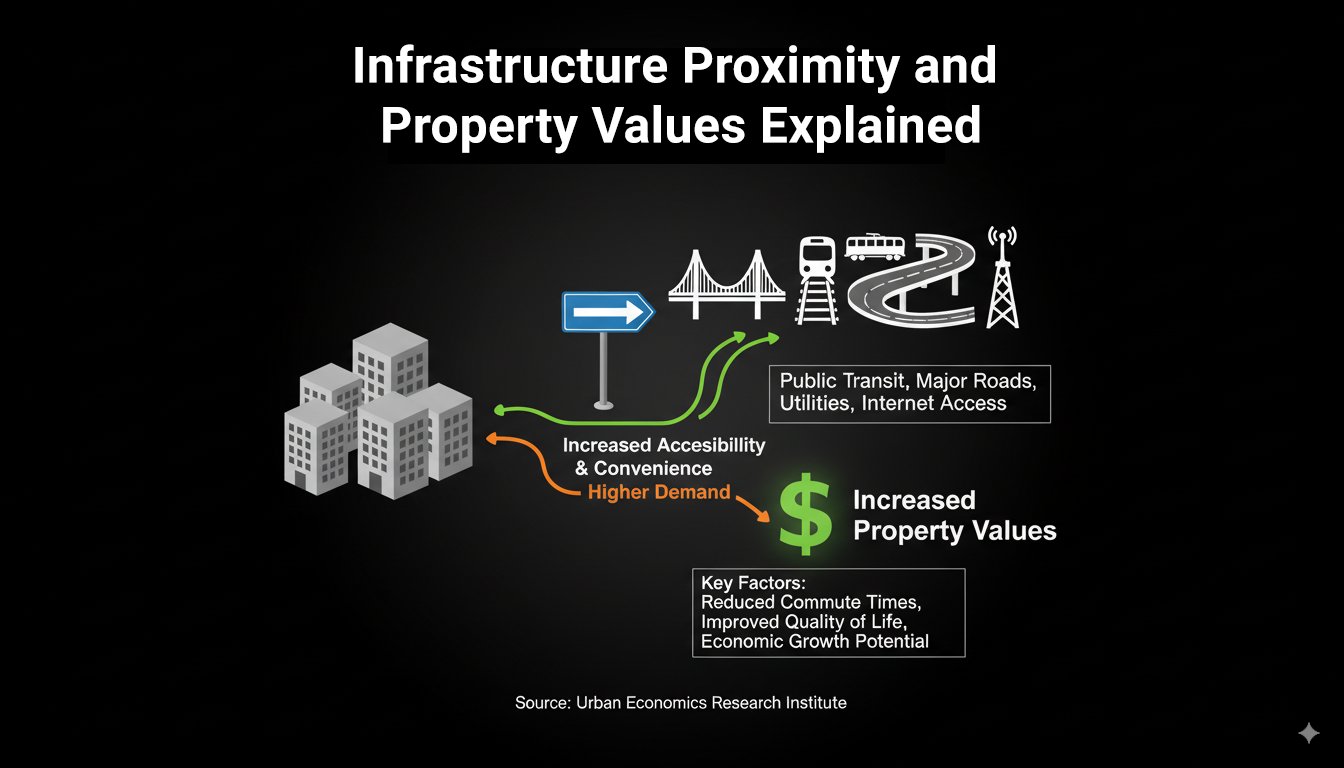

Before diving into the case mini-studies, it’s vital to understand the nexus between infrastructure development and real estate value. Infrastructure increases accessibility and convenience—two factors that directly correlate with property demand.

Common types of infrastructure that influence housing markets:

– Transportation networks (e.g., freeway interchanges, light rail extensions)

– Utilities (e.g., water and sewage systems, fiber-optic networks)

– Social infrastructure (e.g., schools, hospitals, and public amenities)

When infrastructure is introduced or enhanced in an area, it typically:

– Boosts desirability among potential buyers and renters

– Spurs new development and revitalizes aging neighborhoods

– Encourages upward shifts in pricing and absorption rates

This background sets the stage for our case studies, where we measure the tangible effects of infrastructure proximity on real estate performance.

Case Study #1: Properties Within 0.5 Miles of New Infrastructure

In the first mini-study, we analyzed two residential developments located within half a mile of a new commuter rail station and a highway expansion in a rapidly growing metropolitan area.

Key findings:

– Average home prices increased by 18% over a 12-month period post-infrastructure completion.

– Absorption rate accelerated dramatically—from an average of 3 homes/month to 7 homes/month.

– 60% of the buyers cited “easy commute” and “connectivity improvements” as primary purchase motivators.

Benefits observed:

– Increased foot traffic translated to higher visibility and sales for nearby commercial outlets.

– Local governments provided tax incentives for transit-oriented developments, further stimulating the market.

These findings suggest a strong causal relationship between proximity to transportation infrastructure and increased market activity.

Case Study #2: Properties Located 3+ Miles Away from Infrastructure

Next, we contrast this with two similar property developments situated more than 3 miles away from the same infrastructure projects. These communities did not benefit from the improved transportation access or tax incentives.

Key findings:

– Property prices grew at a modest 6% over the same 12-month period.

– Absorption rate remained relatively flat at 2 to 3 homes/month.

– Fewer buyers expressed urgency or strong motivation to purchase in these locations.

Some factors that hindered growth:

– Continued dependence on longer car commutes led to lower buyer interest.

– Retail and social amenities lagged behind, decreasing the area’s appeal.

Though these locations were part of the broader metropolitan area, their detachment from infrastructure significantly limited their real estate growth potential.

What These Mini‑Studies Reveal About Investment Strategy

The contrast between the two case studies sheds light on effective real estate investment strategies. Proximity to infrastructure isn’t just a minor perk—it’s a key market driver.

Important investment considerations:

– Predict future projects: Monitor city council meetings, regional transportation plans, and utility upgrades.

– Time your entry: Buy before project completion to maximize appreciation.

– Target underserved amenities: Develop or invest where infrastructure improves but retail and social offerings lag—value tends to follow.

Investors, brokers, and developers can use this data-driven insight to navigate market shifts and identify both near-term and long-term opportunities.

Key takeaways:

– Properties near new infrastructure outperform remote counterparts in both price appreciation and absorption.

– Infrastructure proximity attracts more motivated buyers, often leading to faster sales cycles.

– Long-term investment success hinges on proactive planning and understanding future infrastructure developments.

Conclusion

The analysis of these mini-case studies clearly reinforces a powerful principle: location remains king in real estate—but it’s location in context. Properties near new or improved infrastructure experience stronger price gains and absorption than those situated further away. This isn’t just a matter of convenience; it’s rooted in demand economics.

For investors, developers, and policymakers, the message is clear—put infrastructure at the heart of your planning strategy. Not only does it shape communities, but it shapes the bottom line.

Take action today by mapping out upcoming infrastructure developments in your region and assessing how your current or future real estate projects align with those growth patterns.

Want to explore more strategic investment guides? Check out our related article on “Transit-Oriented Development: A Guide to Smart Urban Investment” or subscribe to our newsletter for monthly market trend insights.